by Allen Michael Hines

This turn in the cycle of economic boom and bust could have been avoided, the Financial Crisis Inquiry Commission (FCIC) explained in its 600-page final report, released last week.

The collapse that began in 2007, according to the report, could have been prevented if banks hadn’t been recklessly greedy and if the push for deregulation had not happened. These ifs, though, defy capitalism and the drive for profits.

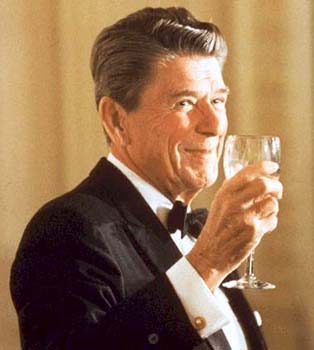

In large part, the commission’s report treats the crisis as a problem in US financial markets and focuses on deregulation since Pres. Ronald Reagan. Focusing only on domestic finance from the 1980s onward presents a skewed image of capitalism gone bad, corrupted by unscrupulous money-grabbers. An international scope and slightly larger time frame reveals that capitalism’s incessant hunt for profit itself breeds turmoil.

In large part, the commission’s report treats the crisis as a problem in US financial markets and focuses on deregulation since Pres. Ronald Reagan. Focusing only on domestic finance from the 1980s onward presents a skewed image of capitalism gone bad, corrupted by unscrupulous money-grabbers. An international scope and slightly larger time frame reveals that capitalism’s incessant hunt for profit itself breeds turmoil.

It may be helpful to chart the boom that preceded the bust we’re suffering through, starting with post-war development. After World War II, Europe, destroyed by the conflict, had little capacity for production. The United States, on the other side of the Atlantic, remained unscathed and production-ready. In the 1950s, US manufacturing boomed and private bank credit was put to use domestically. Financial markets were regulated. The world had made strides to guard against another large-scale armed conflict, as well as another economic collapse.

A sense that the worst had passed continued through much of the sixties. The American Dream was still attainable for many white people, and the middle class continued to grow in proportion to the population. Credit largely remained inside the United States. By and large, banks continued to make money with traditional services, such as stable home loans.

In the 1970s, though, US banks began lending to foreign countries in earnest. To recycle the petrodollars surging into their coffers and to pay the interest due petrodollar owners, banks made loans to developing countries, particularly in Latin America, at extraordinarily low rates. Several factors contributed to Latin America’s hunger for loans. Among them were graft by dictatorships, the failure of import-substitution industrialization and lack of demand for exports to the United States.

Money from loans was going to clearly unsustainable projects or to leaders’ Swiss bank accounts, and borrower countries racked up billions in debt, often with few structural improvements and little economic development to show for it. Borrowing to finance debt was common.

The debt burden on developing countries grew more unmanageable after the US Federal Reserve increased interest rates in 1979, making loans more difficult to get and to repay. In Argentina in the 1980s, interest on debt ballooned to 16 percent.

US banks shifted away from the developing world, back to domestic profiteering. When international lending dried up, heavily indebted borrower countries were unable to finance their loans. Recognizing the dangers to banks that had given loans to over-extended countries and the impact nonpayment could have on the financial system, the US government and the International Monetary Fund (IMF) came up with the Brady Plan. Under the plan, banks would cancel part of borrowers’ debts in exchange for IMF assurance that the remaining debt would be paid. Consequently, the IMF gained more influence in those countries and leveraged that influence to demand structural adjustment.

In short, the US government, which holds a controlling stake in the IMF, bailed out banks that made predatory loans with poor prospects of repayment.

While the debt crisis of the eighties was a good time to re-evaluate devil-may-care lending and reassert the need for regulation, it occurred during Reagan’s presidency. Political geographer David Harvey argues that neoliberalism, the main force behind deregulation, was a way of redrawing class lines in favor of the rich. And Reagan was a friend big business could depend on. So the crisis passed and deregulation continued.

Deregulation and easy credit, even to borrowers who would struggle to repay the loans, were fundamental problems in the real estate market leading to the current crisis. When the housing bubble burst, declining home equity meant bills went unpaid and people were forced from their homes. Retirement funds that invested in real estate took big hits, and as the dominoes fell, unemployment soared.

Capitalism will always bring overproduction, whether of tangible goods or of the various forms of securities cooked up by the financial industry. When production, compelled by competition among firms, overwhelms the market, collapse happens.

Regulation is a barrier to capitalist exploitation. We can see that once a market becomes too small or confined by regulation, business goes elsewhere.

From World War II to the seventies, the domestic financial markets and traditional fixed, 30-year mortgages met the industry’s needs. But with the increase in oil prices and the drive to re-invest petrodollars, the regulated US market was no longer big enough to absorb investments. Private US banks turned to the international markets. Loosely regulated, these banks gave billions of dollars in loans to developing countries.

Soon after banks turned back to the United States in the 1980s, Pres. Reagan initiated full-blown deregulation, and new forms of securities were bought and sold on the market. Ballooning growth in newfangled securities and a mistaken faith in perpetually rising home prices brought us this crisis.

The crisis was avoidable, though smart business practices were not the way of avoiding it. Smart business, under this economic system, consists of exploiting markets, however possible. To improve the potential for exploitation, industries push back against regulation, and politicians cave. Crises are not accidents we can learn from and prevent; they are inherent to the system. The only way to avoid capitalist crisis is to get rid of capitalism.