by Allen Michael Hines

This turn in the cycle of economic boom and bust could have been avoided, the Financial Crisis Inquiry Commission (FCIC) explained in its 600-page final report, released last week.

The collapse that began in 2007, according to the report, could have been prevented if banks hadn’t been recklessly greedy and if the push for deregulation had not happened. These ifs, though, defy capitalism and the drive for profits.

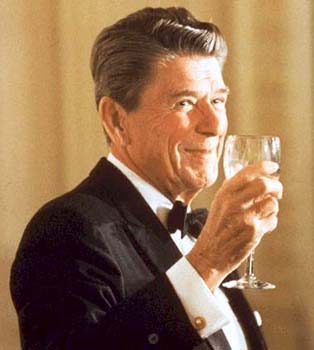

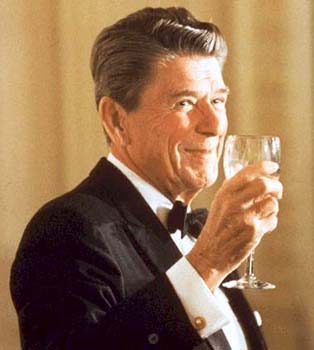

In large part, the commission’s report treats the crisis as a problem in US financial markets and focuses on deregulation since Pres. Ronald Reagan. Focusing only on domestic finance from the 1980s onward presents a skewed image of capitalism gone bad, corrupted by unscrupulous money-grabbers. An international scope and slightly larger time frame reveals that capitalism’s incessant hunt for profit itself breeds turmoil.

In large part, the commission’s report treats the crisis as a problem in US financial markets and focuses on deregulation since Pres. Ronald Reagan. Focusing only on domestic finance from the 1980s onward presents a skewed image of capitalism gone bad, corrupted by unscrupulous money-grabbers. An international scope and slightly larger time frame reveals that capitalism’s incessant hunt for profit itself breeds turmoil.

It may be helpful to chart the boom that preceded the bust we’re suffering through, starting with post-war development. After World War II, Europe, destroyed by the conflict, had little capacity for production. The United States, on the other side of the Atlantic, remained unscathed and production-ready. In the 1950s, US manufacturing boomed and private bank credit was put to use domestically. Financial markets were regulated. The world had made strides to guard against another large-scale armed conflict, as well as another economic collapse.

A sense that the worst had passed continued through much of the sixties. The American Dream was still attainable for many white people, and the middle class continued to grow in proportion to the population. Credit largely remained inside the United States. By and large, banks continued to make money with traditional services, such as stable home loans.

[…]